Physical to Demat

Secure Your Wealth: Convert to Demat Today!

Process Flow

1.

Research and find

2.

Informing you about your wealth

3.

Documentation

4.

Manage everything on your behalf

5.

Confirmation from company side

6.

Credit your wealth

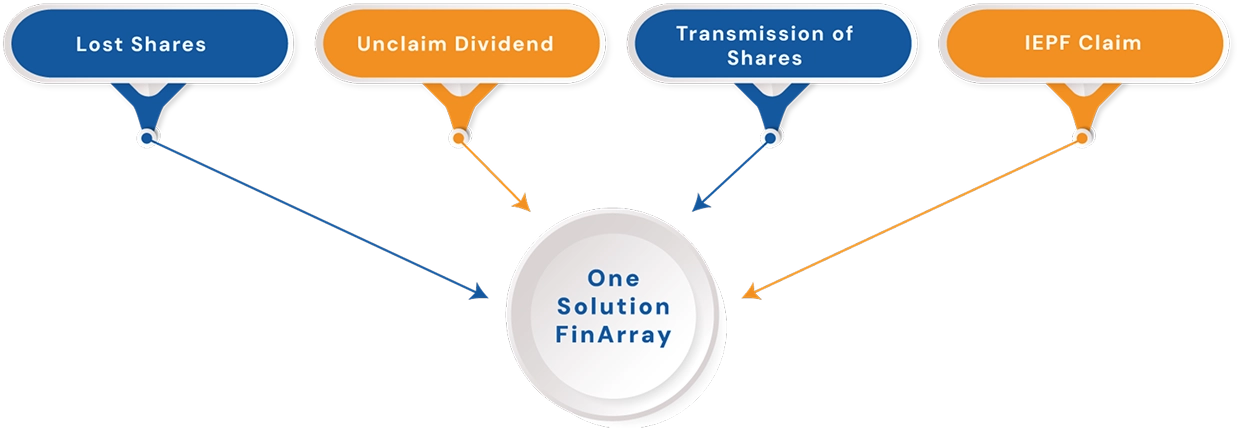

From Physical to Digital: Simplify Your Share Transfer with FinArray’s 'Physical to Demat' Services:

The Securities and Exchange Board of India (SEBI) has prohibited the transfer of physical share certificates since April 1, 2019, with the exception of transmission and transposition:

Now, all share and debenture transactions must occur through a DEMAT account. However, opening a DEMAT account can bring challenges, like signature mismatches or name discrepancies between your documents and the share certificates.

FinArray’s experts at “Shares Recover” can help you resolve these issues when opening a DEMAT account and converting your physical shares to Demat form.

The FinArray team can help you get back shares that were moved from your DEMAT account to the IEPF. When recovered, these shares go back into your DEMAT account, not as physical certificates.

From paperwork to digital—FinArray makes dematerialization easy for you!

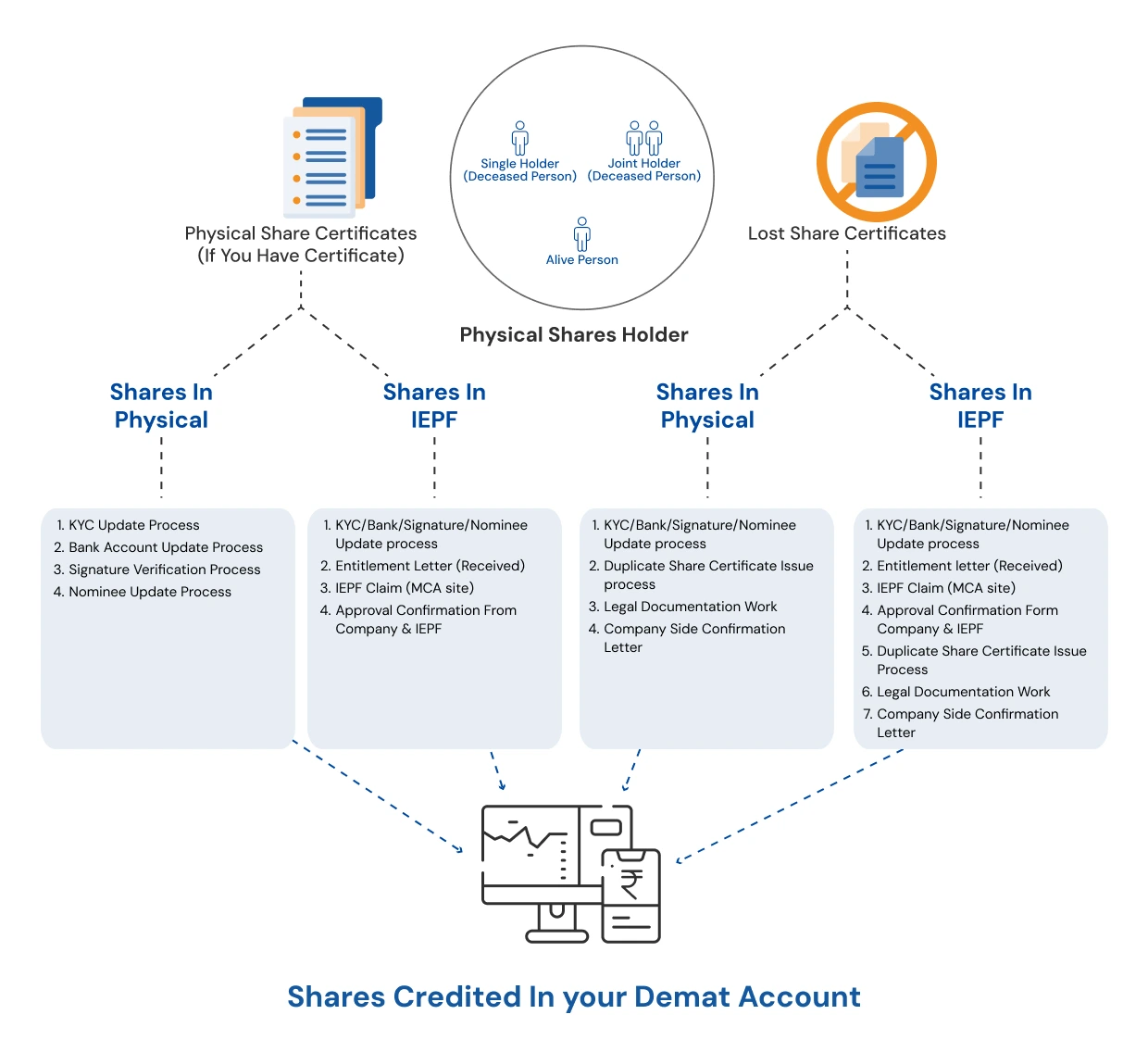

Do you have Physical shares in your house ? Don’t know what to do about it? Let’s find out!

Frequently Asked Questions

1. What if my physical shares are lost? Can they still be dematerialized?

Yes, but you’ll first need to obtain duplicate share certificates. FinArray specializes in assisting clients with the procedure to recover lost shares, including liaising with the company registrar and regulatory bodies.

2. Can I dematerialize shares of delisted or unlisted companies?

Yes, shares of delisted or unlisted companies can also be dematerialized. However, the process may vary. FinArray’s team has the expertise to handle such cases effectively.

3. Can FinArray assist with the dematerialization of inherited shares?

Absolutely! FinArray specializes in handling transmission of shares and dematerialization. We guide you through the legal and regulatory requirements to ensure the shares are smoothly transferred to your demat account.

4. How can FinArray help with physical to demat conversion?

FinArray offers end-to-end support, including:

- Tracking your wealth

- Document preparation and submission

- Coordination with RTA

- Resolving discrepancies

- Tracking the process until completion

We ensure a smooth, hassle-free experience for our clients.

5. Can I dematerialize shares of a company that has merged or changed its name?

Yes, but you need updated documentation reflecting the company’s new name or merged entity. FinArray can help trace the merger details and guide you through the required steps.

6. Are there any tax implications for inherited shares?

No tax is applicable at the time of inheritance, but capital gains tax may apply when you sell them. FinArray can guide you on tax planning and compliance.