Ready to take control of your family’s financial future? Book your personalized appointment with FinArray now!

Our Services – an Eagle Eye View

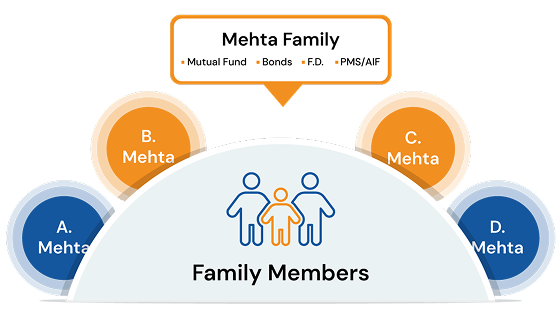

1. Unified View of Your Family’s Financial Picture

With FinArray, easily bring together your family’s entire mutual fund portfolio into one cohesive view.

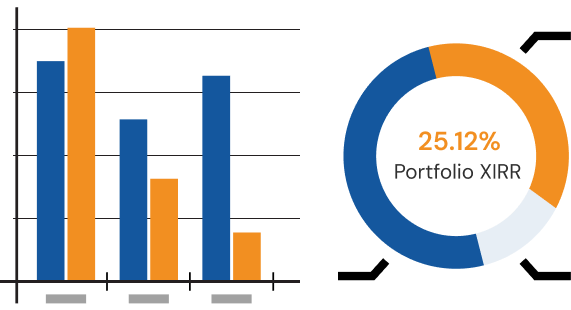

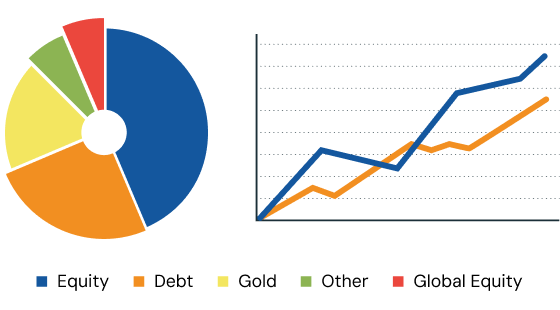

2. In-Depth Portfolio Insights and Analytics

Gain clear visibility into portfolio performance, track Scheme return against indices, and fully understand your asset allocation since inception.

3. Effortless Data Integration Through Advanced Automation

Seamlessly sync your data across financial institutions for all asset classes.

4. Customized Reports for Family Financial Insights

Generate reports for Portfolio Valuation, XIRR, Comprehensive Portfolio, Portfolio Screener, Text Reports, and Redemptions Simulation, all customized for your needs.

Your roadmap to smarter investing begins here.

Click and follow the process now!

Let’s keep your portfolio error-free:

The steps to request the CAS are as follows:

Step-1. “Click here” to request CAS. (Services for Investors CAS-CAMS + KFintech)

Step-2. Choose the statement type as “Detailed”.

Step-3. Select the option for a “specific period”.

Step-4. Set the starting date as “01/04/1990” and the end date as the current date.

Step-5. In the folio listing, select “with zero balance folios”.

Step-6. Enter the email address that is associated with your investments.

Step-7. Choose any password you would like to use to access the password protected statement.

Step-8. Submit the form.

After completing these steps, you will receive an email with your Consolidated Account Statement attached. Please upload the statement here and provide the password for Analysing your portfolio.

Your Investment, Our Expertise: FinArray's Mutual Fund Insights

Which mutual fund is right for you? Let’s find out !

SIP VS SWP Which is your favourite ?

Delay in SIP? Think Again!! Invest now!

Frequently Asked Questions

1. Is it possible to get a consolidated view of mutual fund holdings?

Yes, it is possible to get a consolidated view of mutual fund holdings inception. Whether your investments are spread across multiple fund houses and distributor, we bring them together.

2. What’s the best way to start investing in mutual funds?

Starting with a clear goal and understanding risk tolerance is key. FinArray’s experts guide you every step of the way.

3. Can I retrieve details of mutual fund investments I no longer remember?

Yes, FinArray helps you track forgotten mutual fund investments through consolidated statements and fund house communication.

4. What are the tax implications for NRIs investing in Indian mutual funds?

The tax implications for NRIs investing in Indian mutual funds depend on the type of fund and how long they hold it. Explore more.

5. Can I analyse my portfolio with FinArray?

Yes, FinArray enables you to analyse your portfolio with expert guidance. We provide comprehensive insights and a tailored approach to help you optimize your investments. Contact your trusted financial partner today!

6. How can I use an SWP to get regular income from my mutual fund investments?

An SWP (Systematic Withdrawal Plan) allows you to withdraw a fixed amount from your mutual fund at regular intervals, such as monthly or quarterly. It provides a steady income stream while keeping your remaining investment active.

FinArray helps you set up and manage your SWP for consistent income while keeping your investments on track.