Budgets don’t always need to be loud to be impactful.

Some budgets excite headlines for a day. Others quietly shape the economy for years.

India’s Union Budget FY27 belongs to the second category.

It reinforces macro stability, stays committed to fiscal discipline, and simultaneously continues investing in the engines that drive long-term growth.

Rather than chasing short-term popularity, this budget focuses on credibility, continuity, and capacity-building – three pillars that matter most to investors and markets.

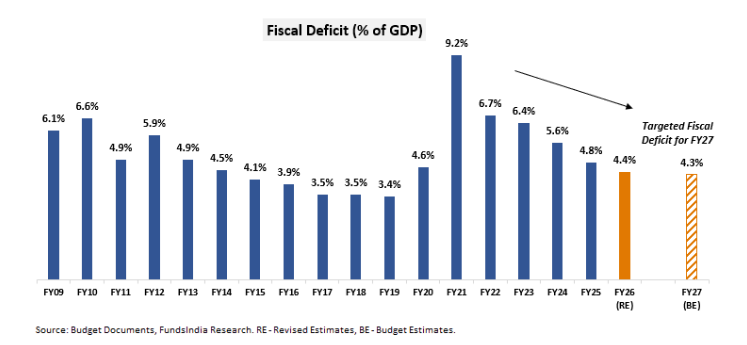

Fiscal Consolidation: Strengthening the Foundation

One of the strongest signals from Budget FY27 is the government’s commitment to fiscal prudence. The fiscal deficit has been pegged at 4.3% of GDP, marginally lower than 4.4% in FY26, keeping India firmly on its consolidation path.

Equally important is the steady improvement in the debt-to-GDP ratio, estimated at 55.6% for FY27, down from 56.1% in FY26. This reinforces fiscal discipline aimed at lowering government debt to approximately 50% of GDP by 2030.

For markets, this matters. Fiscal discipline enhances India’s credibility, supports sovereign ratings, and creates room for private investment without crowding it out. It also provides long-term investors with confidence that growth is being built on a sustainable base, not excessive borrowing.

Capital Expenditure: Growth Through Investment, Not Excess

While maintaining fiscal discipline, the government has not pulled back on growth investments. Capital expenditure for FY27 has been increased by ~11% to ₹12.2 lakh crore, equivalent to ~3.1% of GDP.

This continued focus on infrastructure – especially roads, railways, logistics, and urban development – is critical. Public capex has a strong multiplier effect, crowding in private investment, creating jobs, and improving productivity across sectors.

Although the pace of capex growth has moderated compared to previous years, the quality of spending remains intact. This signals a shift from aggressive expansion to efficient, outcome-driven investment – a sign of policy maturity.

Sectoral Reforms: Building Engines for the Next Decade

The FY27 budget goes beyond spending and focuses on structural reforms to improve productivity and employment.

Manufacturing as a Strategic Priority

Manufacturing has been reaffirmed as a core pillar of India’s growth strategy. Policy support through targeted schemes, infrastructure upgrades, and MSME assistance aims to strengthen domestic manufacturing, improve competitiveness, and integrate India deeper into global supply chains.

Services Sector: Moving Up the Value Chain

The services sector receives renewed attention through enhanced skilling initiatives, rationalisation of safe harbour norms, and plans to develop medical tourism hubs. These measures are designed to help India move up the global value chain while creating high-quality employment.

Agriculture: Productivity Over Subsidy

Agricultural reforms continue with higher investments in irrigation, productivity enhancement, and technology adoption. The focus is clearly on raising rural incomes sustainably, strengthening allied sectors, and reducing long-term dependence on subsidies.

Tax Policy: Stability, Simplicity, and Predictability

One of the most reassuring aspects of Budget FY27 is what did not change.

There has been no change in personal income tax or capital gains taxation, providing continuity and predictability for investors. This stability supports long-term financial planning and reinforces confidence among retail and institutional investors alike.

The announcement of a New Income Tax Act effective 1 April 2026 is another structural reform. The objective is to simplify tax laws, streamline compliance, and improve ease of doing business, an important step for both individuals and enterprises.

However, there is a clear signal discouraging excessive speculation, with Securities Transaction Tax (STT) increased for Futures and Options trading.

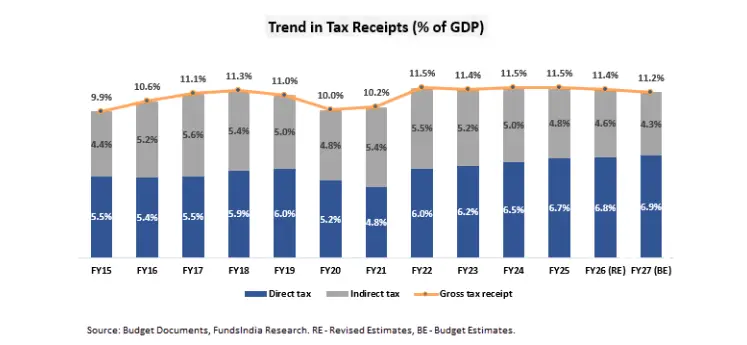

Tax Receipts as a % of GDP remains stable.

What Changes for You as a Consumer & Investor

From a household perspective, the budget brings mixed but balanced changes.

Certain items become cheaper, including foreign travel, cancer treatment medicines, mobile phones, tablets, EV batteries, and solar panels, supporting consumption and sustainability goals.

On the other hand, luxury goods, tobacco products, and certain imported electronics become costlier, reflecting both revenue considerations and policy priorities.

Additional Measures Worth Noting

Several technical but impactful measures were also announced:

- Share buybacks will now be taxed as capital gains instead of dividend income

- TCS reduced to 2% for foreign tours, overseas education, and medical expenses under LRS

- Simplified TDS compliance for property purchases from NRIs

- Higher investment limits for eligible overseas investors

- Rationalisation of tax dispute resolution to reduce litigation and compliance stress

Together, these steps aim to improve transparency, reduce friction, and encourage formalisation.

Market Outlook: FinArray Perspective

Equities: Constructive Long-Term Outlook

From an equity market perspective, Budget FY27 supports a positive medium- to long-term outlook.

India appears to be in the mid-phase of an earnings cycle, driven by manufacturing revival, improved bank balance sheets, real estate recovery, early signs of corporate capex, and strong domestic consumption.

Valuations remain neutral, and market sentiment is balanced rather than euphoric – a healthy setup for long-term investors. Strong domestic inflows via SIPs and institutions continue to offset muted FII participation, leaving scope for future upside if global flows improve.

Fixed Income: Stability with Near-Term Caution

The fiscal deficit number and debt reduction roadmap are supportive for bond markets. However, higher market borrowing in FY27 could keep yields elevated in the near term. Medium- to long-term debt investors, however, benefit from improved visibility on fiscal sustainability.

Final Word: A Budget That Plays the Long Game

Budget FY27 is not designed to impress overnight. It is designed to endure.

By balancing fiscal discipline with targeted growth investments, structural reforms, and tax stability, it lays the groundwork for sustainable wealth creation over the coming decade.

At FinArray, we believe this environment continues to favour disciplined investing, long-term equity allocation, and diversified portfolios aligned with India’s structural growth story.

Disclaimer: This content is for informational purposes only and not investment advice. Market risks apply; please consult a qualified financial advisor before investing.